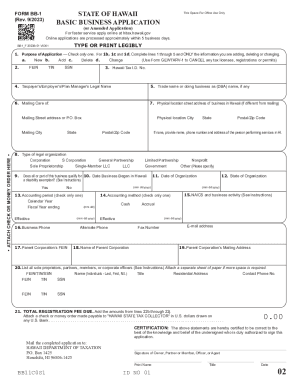

HI DoT BB-1 2001 free printable template

Get, Create, Make and Sign form bb 1

How to edit form bb 1 online

Uncompromising security for your PDF editing and eSignature needs

HI DoT BB-1 Form Versions

How to fill out form bb 1

How to fill out HI DoT BB-1

Who needs HI DoT BB-1?

Instructions and Help about form bb 1

Hi Timmy let loose how are you today I'm going to show you how to apply for a general excise tax license in the state of Hawaii I'm going to share my screen right now with you, so I can show you the website to go to you can get this done online or in person so go to portal de Hawaii gov and select business you want to start a business here you can register your business online or get more information on the business action center so let's go to register your business online first and most of you will probably want to do this online here is your business express you will pay with a credit card before you do that do a business name search and what you want to do is enter your business name there so let's pretend I want to start a business in Hawaii with the main Starbucks let's do a search here if a name shows up like this you cannot use it is having already taken you see it says active that means there is a company that uses that name so let's say I wanted to call my business fabulous nails okay because we can't use color street in our registered business name okay do not use color Street Oh fabulous nails would be available, so I if I wanted to I could register a new business under fabulous nails and be ready to go and have a business license in my name okay so do a business search before you either go in physically or before you register online now if you're going to register in person I recommend filling out this eb1 form prior to going in there and all you need to do is download the form here go to theirs a fillable this is a BB 1 packet go to the fillable or to handwrite over one we're going to handwrite it, so we're gonna print this form and complete everything as much as possible before going down to Nimitz you can always ask questions there again the business action Center has all the information that you need here are some steps 1 through 7 on how to start a business again you do not need to have a business license a GE license to run your color Street business but if you do happen to sign up for event most vendors vendor events have to have a business license on hand they want to know that you're going to be taking care of the general excise tax on your own that they're not responsible it's always good to have a business license I'm going to show you what mine looks like this is my business license here I have it under an LLC, so I carry it with me on my clipboard whenever I go to vendor events and that way I know that uncovered if anyone ever comes to check if I have a business license, so I hope that helps if you have any questions please feel free to contact me I'm by no means a tax preparer or know everything about taxes, but I do know how to apply for business license and I just showed you how take care now

People Also Ask about

Why do I need a tax ID number?

What is Hawaii bb1 form?

How do I start my own business tax return?

Does Hawaii have a business income tax?

What is a BB-1 form Hawaii?

Who must pay Hawaii general excise tax?

Who is subject to Hawaii general excise tax?

Who is a resident of Hawaii for tax purposes?

How do I file my business taxes in Hawaii?

Do individuals have a Hawaii tax ID number?

How do I get a Hawaii tax ID number?

What taxes does an LLC pay in Hawaii?

How much is an EIN number Hawaii?

Who needs Hawaii tax ID number?

Who needs a general excise tax number in Hawaii?

Does Hawaii have an LLC tax return?

Who needs Hawaii tax ID number?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form bb 1 directly from Gmail?

How do I edit form bb 1 in Chrome?

How do I edit form bb 1 on an Android device?

What is HI DoT BB-1?

Who is required to file HI DoT BB-1?

How to fill out HI DoT BB-1?

What is the purpose of HI DoT BB-1?

What information must be reported on HI DoT BB-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.